Life Insurance in and around Blanchard

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

When you're young and newly married, you may think you don't need Life insurance. But it's a perfect time to start thinking about Life insurance to prepare for the unexpected.

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Agent Larry Gosney Jr, At Your Service

Life can be just as unpredictable when you're young as when you get older. That's why now could be a good time to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for coverage for a specific time frame or coverage for a specific number of years, State Farm can help you choose the right policy for you.

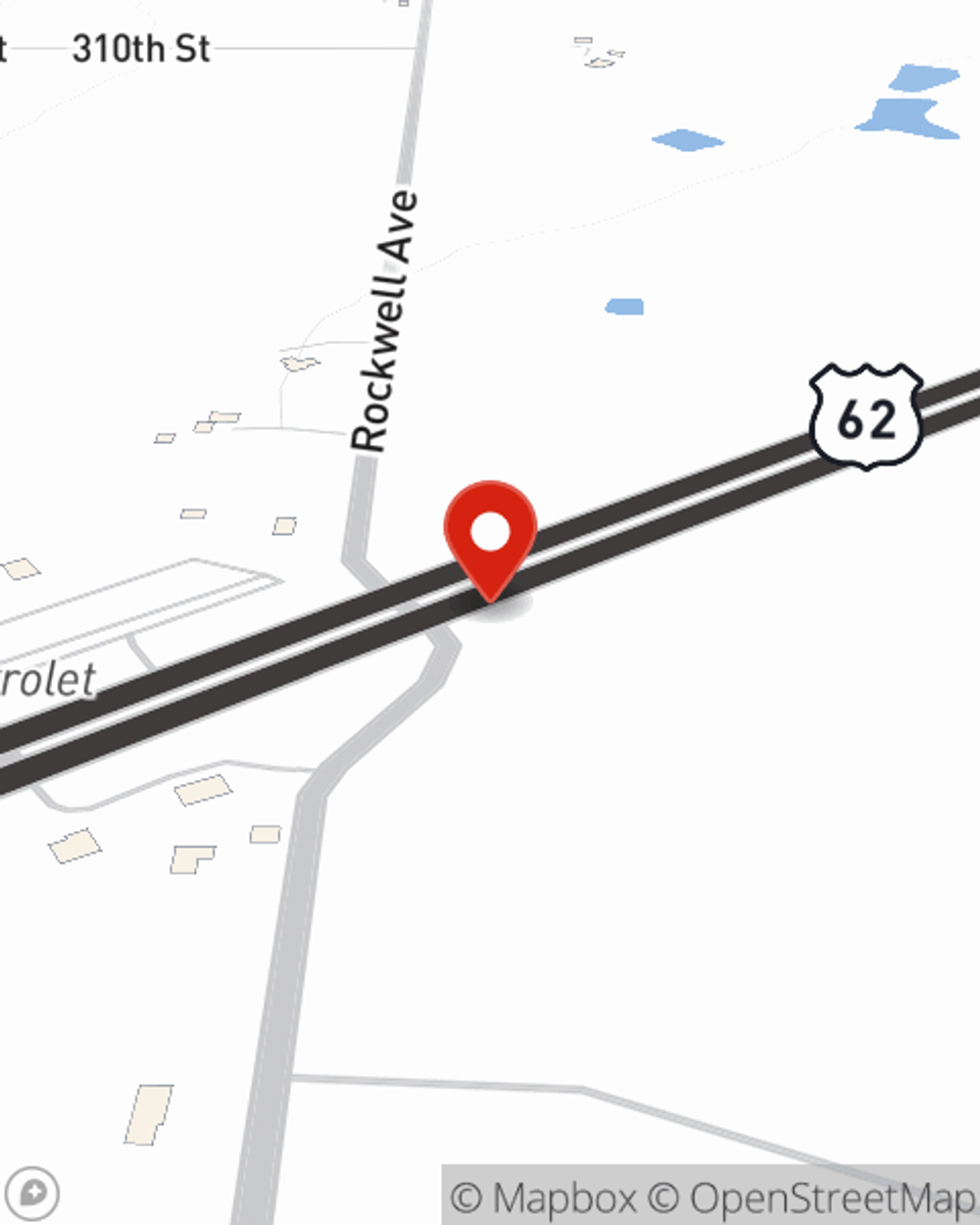

As a dependable provider of life insurance in Blanchard, OK, State Farm is ready to protect those you love most. Call State Farm agent Larry Gosney Jr today and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Larry at (405) 485-2221 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Larry Gosney Jr

State Farm® Insurance AgentSimple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.